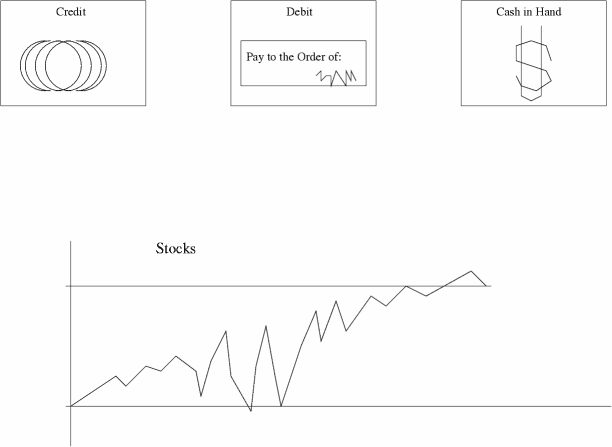

So, I finally posted AS3DMD 4.17. See it up on the AS3DMD website. It supports xml, tar data files, and milkshape models. Bla bla bla. This is short because I haven't posted on JF for a month and I'm just trying to build enough courage to post again. The main problem is starting. Once I've stopped doing JF even one night, I can't start. Night after night I find anything else to do and it's not cool. Talking about not cool, I just looked at my bank account balance. There's not enough to pay my tuition even with my parent's generous contribution. This is to become a lesson in economics: I have two resources credit and debit. A person can pay for anything, but specifically any debts, rent, and phone with debit. A person can purchase items and pay for tuition with credit. By jumping through a few hoops, a person can get a cash advance on credit and put it in debit at a high rate of interest. My credit balance is $1,000. My debit balance is $2,400. I need to pay for $1,994 tuition, $340 rent, and $80 groceries. No problem, right? Wrong. Stupidly, I paid for rent and groceries with debit. That takes me down to $1980 in debit and $1,000 in credit. How do I pay my tuition? Uh oh! Cash advance from credit. I transferred $1,000 from credit to debit. Cash advance takes 7-10 days plus 3 days transit plus one day bank time. My tuition is due in 4 days. I have $0 in credit, $1980 in debit. I am screwed. But wait! Can I call one one of my smaller reserves? I only counted the $1,000 on my high limit card. Maybe I have a $500 limit card that can grant me $100 to pay tuition which I can pay back... Uh huh. Knowledge of credit cards and economics saved the day.

The lesson today is that I used to give credit cards a bad rap without knowing the real purpose of credit cards. I had one and only used it in emergencies. I blamed my friends' huge debts on the credit cards because my friends wouldn't have been able to get into debt if it weren't the credit cards. But now I've lived off three credit cards for 9 months. I can tell you that they are fleecing me, but exactly where do I expect to get $9,000 without working? Do I expect my parents to pick up the tab? Harsh, no? The credit card company is there when I need it. When I don't need it, they are happy to wait because I am one of millions of Americans who are paying 15% interest on $9,000 right now. Compared to my student loans, the interest is pretty high, but if I get a very high ratio of income to expenditure out of school, I can pay back the loans in no time resulting in only paying back 108% of what I got. And I think they definately deserve 8% of $9,000 ($720) for allowing me to slack off for an entire 6 months. It sure has been worth it! I've been having more fun than a person should be allowed. ^_^

My lesson to fellow debtors: play the game, but play it right if you want to win. I mean, making money off the credit card game is an easy scam and the credit card companies want you to play it. Three years ago I told my dad that a good investment would be college students. He can give them a scholarship to their university and dodge taxes. Then they use the money that they would have paid tuition with to pay him back and dodge taxes using their education tax credit. His rate of return would be ~ 20% for one year. In exchange he would pay 5% of the student's tuition. My dad said that he wouldn't do it because he is (was back in 1999) making 25% with his Microsoft stock. My friend David said that his workplace pays for 50% of his tuition, so it wouldn't help him to do this. Then it hit me. My dad can get a $100,000 credit card any time he wants at 10%. He earns 25% on his Microsoft stock. So why doesn't he take out $100k and put it into Microsoft stock netting 15%? Well, this was a few months before the crash of 2000. Silly, huh? But the fact remains. If you can get even 15% guaranteed return on stock (stocks are never guaranteed, but managable risk bla bla bla) and 10% interest on credit card, there's nothing stopping you from printing money. Do I have to remind you that 5% of $100k is $5,000?

-

Leave a Reply

Comments: 0

Leave a reply »